After a sudden slowdown in many housing markets this year, will markets that are “slow and steady” shine in 2023?

Midsize markets, which saw lower price increases and less of an affordability crunch than others, are poised to see the strongest combined growth in home sales and listing prices in the coming year, according to a report from Realtor.com.

With mortgage rates almost doubling since the beginning of the year and home prices continuing to inch up due to low inventory, affordability remains a big concern for buyers.

“Because these midsize markets didn’t really surge to new degrees during the pandemic, they are still relatively affordable,” Danielle Hale, chief economist for Realtor.com, told USA TODAY. “Nearly all of them have prices below the U.S median home price.”

Home sales drop: Pending sales down for fourth straight month

The latest on housing markets:Mortgage rates, home prices and affordability

Housing market predictions for 2023

Topping the list are Hartford-West Hartford, Connecticut, followed by El Paso, Texas; Louisville, Kentucky; Worcester, Massachusetts; Buffalo-Cheektowaga, New York; Augusta, Georgia; Grand Rapids-City of Wyoming, Michigan; Columbia, South Carolina; Chattanooga, Tennessee; and Toledo, Ohio.

“These are the markets that have been relatively slow and steady, and that slow and steadiness is going to help keep the real estate markets relatively active in 2023 in these areas,” Hale said.

Home sales across the top 10 markets are expected to grow by 5.2{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} year over year in 2023, whereas national home sales are projected to experience a decline in sales (-14.1{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}). Average home prices in these top 10 markets are expected to increase 7.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} compared with 5.4{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} nationally.

Million-dollar mortgages:Fannie Mae, Freddie Mac will back mortgages of more than $1 million in 2023

Grinding to a halt? High mortgage rates bring sales and listings down

In the top 10 markets, about 23{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of housing inventory is affordable at the median income level, compared to just 17{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of affordable homes nationally.

Many of these areas flew under the radar in the pandemic frenzy and are now well-positioned to bubble up with solid job prospects without the big-city price tag, Hale said.

“As many households keep a close watch on their spending, we expect these top housing markets to be in relatively high demand,” Hale said. “We’ve seen lower price increases, more general affordability and more use of government-backed mortgage products for veterans, first-time and minority buyers in these top markets, providing opportunities for all home buyers to stretch their homebuying dollars.”

The only metro area on the list with a median home price above U.S. median of $415,750 is Worcester, at $447,000.

Here are some other insights from the report:

Top housing markets did not experience pandemic boom

The top 10 housing markets didn’t get as caught up in 2022’s wild buying frenzy – and price increases – as other areas. Sale prices in the 12 months ending August 2022 increased by 10.5{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} on a year-over-year basis, compared with a growth rate of 12.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} for the 100 largest metros. The top markets have also seen less of a dip in sales in recent months, with sales declining by 9.1{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} year over year, compared to an average decline of 12.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} for all 100 metro areas.

Mortgage rates top 7{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}.:Is a fixed or an adjustable rate the best bet right now?

Midsize housing markets supported by domestic industry

Representing a shift from remote-work and tech-industry influenced homebuying, the projected 2023 top markets have a renewed focus on domestic industry and trade.

On average, these midsize metros employ a higher proportion of workers in manufacturing, government, education and health care jobs relative to the 100 largest U.S. metro areas, while jobs in tech, professional services, information technology and leisure and hospitality are less common in these areas.

Having largely avoided the pandemic housing boom seen in other markets, homebuyers in the top markets can find solid job prospects and affordable housing options.

Housing market grinding to a halt?:High mortgage rates bring sales and listings down

Housing market first-timer?:15+ real estate terms you should know, from FICO to escrow

Out-of-town buyers see these top real estate markets as an option

Almost half of the buyers looking at the top 10 markets are from areas outside those states. In Hartford, with a median price of $375,000 in October, homebuyers from New York, Boston and Washington, D.C., were leading the wave of out-of-state views in the third quarter of 2022, finding significant value compared not only to the high price of houses in New York City ($670,000), but also the national median ($425,000).

With remote-work opportunities still robust and affordability top of mind, these markets will continue to draw buyers from out of state.

Buyers in these housing markets more likely to take FHA and VA loans

Home sales in the top 10 metros also tend to leverage more government-backed mortgage products such as VA loans and FHA loans. Between January and August of this year, the share of mortgaged-sales with a VA loan was 9.4{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in the top 10 markets versus 7.5{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} among all the 100 markets reviewed. These types of loans help buyers safely enter the market with lower down payments and often slightly lower mortgage rates.

2023 top housing markets

1. Hartford-West Hartford, Connecticut

November 2022 median home price: $372,000

Forecasted 2023 home sales change: +6.5{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +8.5{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +15.0{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

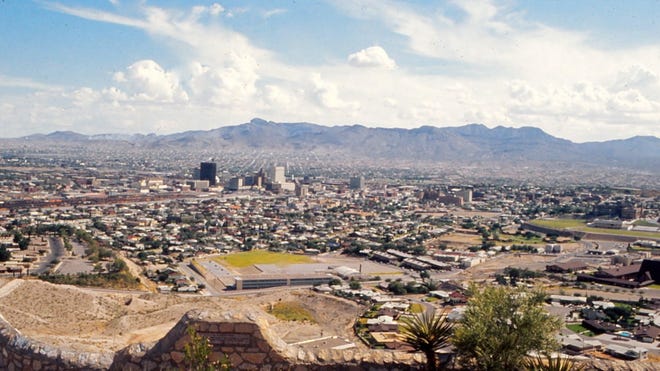

2. El Paso, Texas

November 2022 median home price: $291,000

Forecasted 2023 home sales change: +8.9{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +5.4{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +14.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

3. Louisville, Kentucky

November 2022 median home price: $290,000

Forecasted 2023 home sales change: +5.2{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +8.4{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +13.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

4. Worcester, Massachusetts

November 2022 median home price: $447,000

Forecasted 2023 home sales change: +2.5{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +10.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +13.1{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

5. Buffalo-Cheektowaga, New York

November 2022 median home price: $240,000

Forecasted 2023 home sales change: +6.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +6.0{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +12.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

6. Augusta, Georgia-South Carolina

November 2022 median home price: $319,000

Forecasted 2023 home sales change: +6.2{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +5.7{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +11.9{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

7. Grand Rapids-City of Wyoming, Michigan

November 2022 median home price: $358,000

Forecasted 2023 home sales change: +1.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +10.0{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +11.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

8. Columbia, South Carolina

November 2022 median home price: $300,000

Forecasted 2023 home sales change: +7.7{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +3.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +11.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

9. Chattanooga, Tennessee-Georgia

November 2022 median home price: $397,000

Forecasted 2023 home sales change: +2.9{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +8.2{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +11.1{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

10. Toledo, Ohio

November 2022 median home price: $161,000

Forecasted 2023 home sales change: +4.2{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 home price change: +6.7{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

Forecasted 2023 combined sales and price change: +10.9{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}

More of your Money questions answered

Swapna Venugopal Ramaswamy is a housing and economy correspondent for USA TODAY. You can follow her on Twitter @SwapnaVenugopal and sign up for our Daily Money newsletter here.