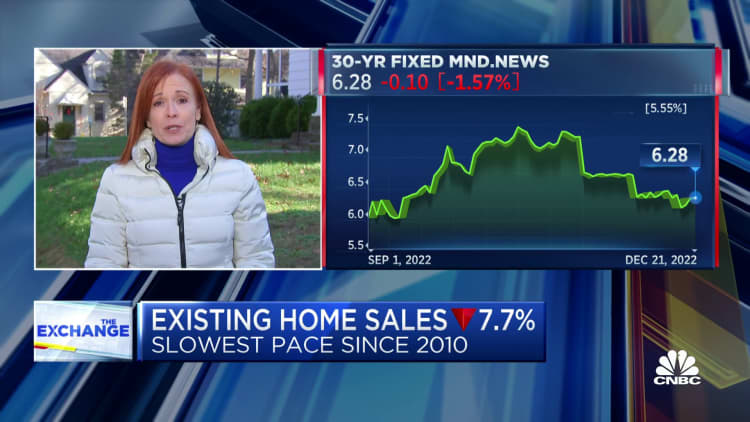

Income of present residences fell 7.7{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in November as opposed with Oct, according to the Nationwide Affiliation of Realtors.

The seasonally adjusted annualized speed was 4.09 million units. That is weaker than the 4.17 million units housing analysts experienced predicted, and it was a substantially further drop than normal regular declines.

Profits ended up down 35.4{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} calendar year around yr, marking the tenth straight month of declines. That was the weakest tempo considering that November 2010, with the exception of May 2020, when profits fell sharply, albeit briefly, for the duration of the early times of the Covid pandemic. In November 2010, the country was mired in the great recession as nicely as a foreclosures disaster.

These counts are primarily based on closings, so the contracts have been very likely signed in September and Oct, when property finance loan rates previous peaked prior to coming down marginally past month. Premiums are now about a single share place decreased than they were at the stop of October, but continue to a tiny more than 2 times what they ended up at the start of this year.

Lane Turner | The Boston Globe | Getty Images

“In essence, the residential real estate sector was frozen in November, resembling the gross sales action witnessed during the Covid-19 economic lockdowns in 2020,” stated Lawrence Yun, NAR’s chief economist. “The principal aspect was the rapid raise in house loan charges, which damage housing affordability and lowered incentives for owners to record their homes. Plus, obtainable housing stock remains near historic lows.”

Go through more: Mortgage loan refinance need surged 6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} past 7 days

At the stop of November there were being 1.14 million homes for sale, which is an increase of 2.7{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} from November of final 12 months, but at the latest revenue speed it represents a nonetheless-lower 3.3 month source.

Small supply saved charges larger than a yr back, up 3.5{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} to a median sale price of $370,700, but those once-a-year gains are shrinking rapid, well off the double digit gains witnessed earlier this calendar year. It is still the greatest November rate the Realtors have ever recorded, and, at 129 straight months, it is the longest functioning streak of 12 months-about-calendar year rate gains because the realtors began monitoring this in 1968. About 23{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of homes marketed earlier mentioned checklist rate, thanks to restricted offer.

“We have seen dwelling charges occur down from their summer months peaks over the previous five months. At the identical time, we have also found hire advancement retreat for 10 consecutive months,” wrote George Ratiu, senior economist at Real estate agent.com in a launch. “Nonetheless, the expense of true estate stays tough for a lot of homes searching for a position to get in touch with household, in particular as higher inflation and nevertheless-elevated curiosity prices have been eroding getting electric power.”

Profits lessened in all regions but fell most difficult in the West, in which rates are the optimum, down virtually 46{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} from a calendar year back.

Properties sat on the industry longer in November, an average 24 days, up from 21 days in October and 18 times in November 2021. Even with the slower current market, 61{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of houses went below agreement in a lot less than a thirty day period.

With charges continue to superior and mortgage charges hitting a cyclical peak, initial-time customers remained on the sidelines. They had been liable for 28{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of gross sales in November, which was unchanged from Oct, and up somewhat from 26{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in November 2021. Historically very first-time potential buyers make up about 40{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of the market. A independent study from the Realtors place the once-a-year share at 26{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, the cheapest considering that they commenced tracking.

Profits fell across all value classes, but took the steepest dive in the luxurious million-greenback-furthermore group, dropping 41{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} year-around-yr. That sector had witnessed the largest get in the very first years of the pandemic.

Mortgage loan fees have appear off their new highs, but it continues to be to be found if it will be ample to offset bigger selling prices.

“The sector could be thawing considering the fact that house loan charges have fallen for 5 straight weeks,” Yun added. “The ordinary month-to-month house loan payment is now just about $200 much less than it was quite a few weeks in the past when fascination charges attained their peak for this yr.”