Mohawk Industries, Inc. (MHK – Cost-free Report) supplied an update on its fourth-quarter 2022 outlook for modified EPS. Due to the fact its past quarter’s earnings launch on Oct 27, 2022, the company witnessed interest fee hike stress, along with large inflation and lagging client self-assurance in the United States and Europe markets. This resulted in more softness in the worldwide residential flooring business than MHK expected.

Because of to this, Mohawk continued with short-term plant shutdowns, which negatively impacted margins and quarterly effects. Also, weak need in Flooring North The us forced Mohawk to lessen its inventory ranges. Owing to these elements, the organization expects fourth-quarter altered EPS in between $1.27 and $1.31, excluding any restructuring or other one-time costs. Before, it anticipated modified EPS of $1.40-$1.50, excluding any restructuring charges. In fourth-quarter 2021, the metric totaled $2.95 for each share. It strategies to launch its fourth-quarter 2022 success on Feb 9.

Aside from this, it signed a deal with plaintiffs to solve the previously disclosed securities class motion lawsuit. At first filed on Jan 3, 2020, in the United States District Courtroom for the Northern District of Ga, this lawsuit could be protracted, burdensome and highly-priced.

Furthermore, Mohawk settled a previously disclosed dispute with the Belgian Tax Authority (“BTA”) about the tax treatment method of royalty income arising from intellectual residence. In April 2022, the BTA issued a tax assessment of €187 million (which include penalties but excluding fascination) for 2013-2018. Although Mohawk thinks its tax place in Belgium is right, it entered an settlement with the BTA on Nov 23, 2022, to settle the dispute for a a person-time payment of €3 million.

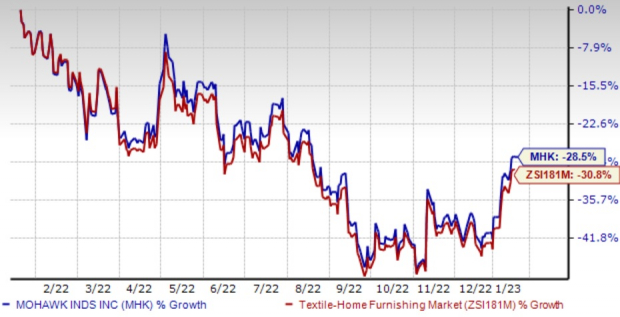

This Zacks Rank #3 (Keep) company’s shares have declined 28.5{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in the earlier calendar year in contrast with the Zacks Textile – Property Furnishing industry’s 30.8{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} fall. For 2023, earnings estimates of $10.28 per share propose a 21{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} 12 months-around-yr decline. You can see the entire list of today’s Zacks #1 Rank (Robust Invest in) shares right here.

Picture Resource: Zacks Financial commitment Study

Critical Picks

Some much better-rated shares in the Zacks Client Discretionary sector are World Wrestling Leisure, Inc. (WWE – Totally free Report) , Royal Caribbean Cruises Ltd. (RCL – Free of charge Report) and Manchester United plc (MANU – Totally free Report) .

Environment Wrestling Enjoyment at present sports a Zacks Rank #1. WWE has a trailing four-quarter earnings surprise of 25.2{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, on ordinary.

The Zacks Consensus Estimate for WWE’s 2023 gross sales and EPS suggests a increase of 4.9{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} and 10.7{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, respectively, from the 2022 believed levels.

Royal Caribbean presently sporting activities a Zacks Rank #1. RCL has a trailing 4-quarter earnings shock of adverse 1.8{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, on average.

The Zacks Consensus Estimate for RCL’s 2023 profits and EPS indicates a rise of 43.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} and 138.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, respectively, from the calendar year-back documented levels.

Manchester at present flaunts a Zacks Rank #1. MANU has a trailing four-quarter earnings surprise of 34.4{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, on common.

The Zacks Consensus Estimate for MANU’s 2024 sales and EPS suggests a rise of 11.4{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} and 27.8{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, respectively, from the 12 months-ago reported stages.