andreygonchar/iStock via Getty Images

Investment Thesis

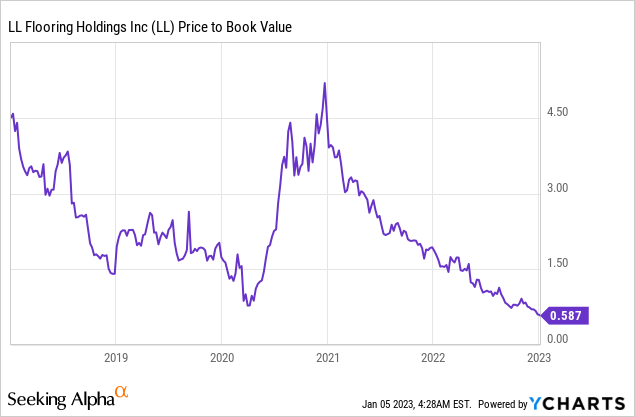

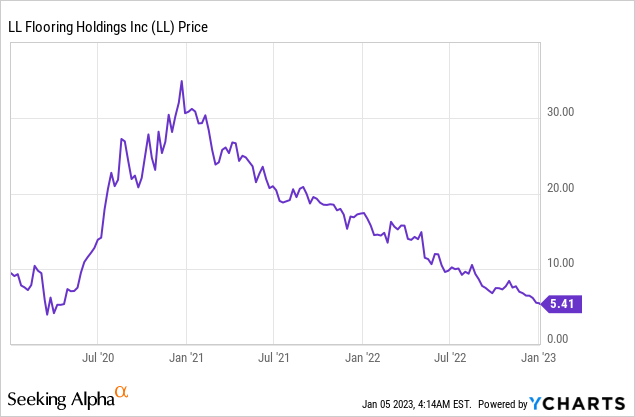

Shares of LL Flooring (NYSE:LL) have plummeted by over 80{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} from the recent high two years ago (Jan 2021). The stock dropped to a level that was only seen during the Covid-19 pandemic. Although LL only trades at 60{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of its book value, I rate the company as a “Hold” due to its lack of competitiveness and near-term headwinds.

Well-adapted to Industry Tailwind

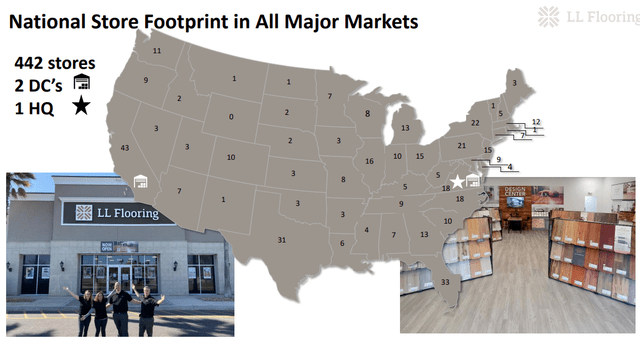

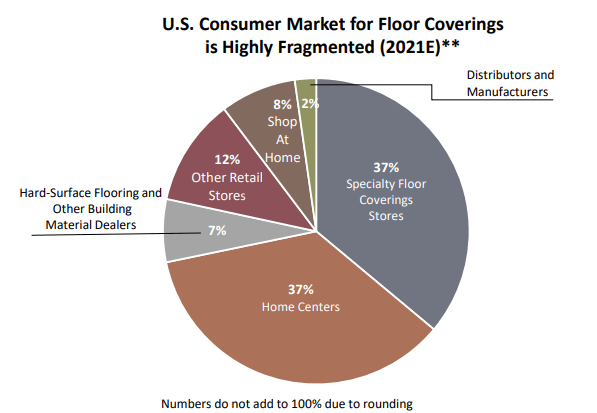

The U.S. hard surface floor covering market is highly fragmented. Its addressable market size is estimated to be $36 billion, with an expected growth rate of 8.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} CAGR. With 442 stores across the U.S., LL continues to grow its store count to expand the company’s footprint and gain market share.

LL Flooring

LL pointed out in the company’s latest investor presentation slides that hard surface flooring will outpace soft surface flooring (e.g. carpet), and vinyl plank will outpace other types of flooring as consumers shift to durable and waterproof products. Indeed, the market share of hard surface flooring grew from 50{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in 2016 to 57{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in 2021 in the floor covering market.

The company is well-positioned to adopt such consumer trends. Apart from focusing on the hard surface floor covering sector, its gradual secular shift from solid and engineered hardwood products to manufactured products (e.g. laminate, vinyl and porcelain tile) shall maintain LL’s competitiveness. Total sales of manufactured products rose from 41{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in 2019 to 48{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in 2022 Q3, while hardwood products dropped from 29{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in 2019 to 23{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in 2022 Q3 (p.8 of Form 10-Q).

The shift also reduces the cyclical factor led by lumber prices, which is positive for the company’s development and profitability. The cost of various hardwood species is essential to LL’s profitability on hardwood products. If LL fails to react to the surging hardwood costs promptly, it could cause the operating results to deteriorate.

Solid Balance Sheet

Although the capital expenditure of LL has been on a rising trend in recent years, from $7.4 million in 2017 to $24 million in TTM, which may generate cash flow problems, the balance sheet of the company generally remains solid. LL currently holds $6.1 million worth of cash or equivalents but owns $69 million of debt via a Revolving Credit Facility at a weighted average interest rate of 4.6{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}, which may be concerning (p.10 of Form 10-Q).

However, the amount of debt that LL possessed is only a fraction of its asset size, and its equity-to-asset ratio is also solid. A summary of financial strength ratios is tabled below for easy reference.

| Debt-to-Equity Ratio | 0.76 |

| Debt-to-Asset Ratio | 0.31 |

| Equity-to-Asset Ratio | 0.41 |

(Source: Author, with data from Gurufocus)

Lack of Competitiveness

Despite the positive changes that the company has made in recent times, like setting up its website with montages available and its focus on the Pros, LL continues to lack competitiveness in my view. The company’s major competitors could be divided into three major categories:

- Large home improvement retailers (Home Depot (HD) and Lowe’s (LOW))

- Specialty retailers (Floor and Decor (FND) and LL)

- Mom and pops shops

LL Flooring

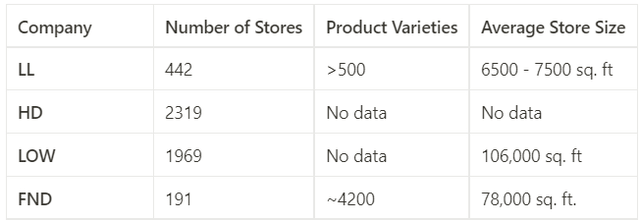

Large home improvement retailers have the largest store count and the broadest range of home improvement products (e.g. not limited to hard surface flooring only). For instance, HD owns 2,319 stores across the U.S., Canada and Mexico, and flooring is only accountable for 6.1{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of its total sales in 2021 (p.50 of Form 10-K).

Specialty retailers have a great variety of products and a higher number of stock-keeping units (“SKU”). For example, FND offers products from over 60 proprietary brands and approximately 4200 SKUs in each store. However, FND only has 197 stores and studios, which is less than one-tenth of Home Depot’s store count (p.13 of Form 10-K).

The fact that LL is less accessible than large home improvement retailers and offers less variety of products than its specialty retailing peers has put the company in an awkward position to compete. Based on my own research on LL’s website (accessed on 5 January 2023), there are only 17 styles of porcelain tile available sitewide, and skirting tiles are also lacking.

Please find the table below for the compiled data of major players in the hard surface floor covering market.

Compiled by Author

I think the lack of competitiveness has led LL to an average financial result over the past decade. The company recorded net losses in 4 years over the last decade, and revenue merely grew by 15{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} from 2013 to 2021. In the previous quarter, LL recorded a narrowing gross margin (down 170 bps YoY), an adjusted loss per diluted share of $0.14 and comparable store sales dropped 7.3{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} YoY.

High Inventory Level

The high level of inventories is also concerning, as inventory rose by almost $110 million in 2022. The company explained its move as to supporting the company’s strategy to place inventory close to its customers and to support new stores.

I found its situation similar to its competitor, FND, which I covered earlier this month:

Styles of tiles and hard flooring materials are like clothes in your closet. They will change seasonally. Thus, the increasing inventory level is my concern, as old-fashioned floor covering materials could become outdated. There is a risk that the company will mark down the prices to clear the excessive and out-of-style inventories.

However, the management team of LL believes that they have built a solid mix of quality flooring inventory that is largely evergreen in nature.

Potential Macro Headwind

Housing has been the least affordable in recent years as mortgage rates surged. As abstracted from Freddie Mac, the current 30-year fixed rate mortgage is 6.42{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb}. Even though it has dropped by 66 bps from its high, it is still well above the 52-week average.

Besides, the Housing Affordability Index issued by the National Association of Realtors also reflected the problem: the Index fell to 91.2 in October 2022. According to the Association, a value lower than 100 means that a family with the median income has less than enough income to qualify for a mortgage on a median-priced home.

The above and the declining existing home sales will likely reduce home improvement and maintenance demand. Indeed, The Leading Indicator of Remodeling Activity expected home improvement and maintenance expenditures would peak in the second quarter of 2023.

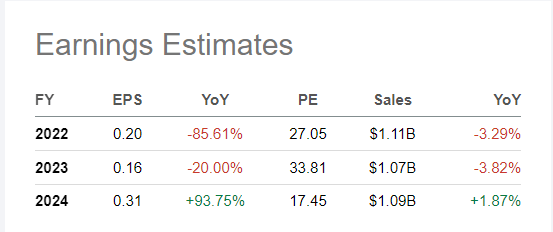

Thus, the company may face macro headwinds caused by the deteriorating housing market in 2023, which will likely cause disappointing operating results. Analysts estimate the EPS of LL to decline another 20{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} in 2023 after a disappointing 2022.

Seeking Alpha

Valuation and Conclusion

As LL’s earnings are cyclical, it is less appropriate to compare its historic P/E ratio to the current P/E ratio. On the contrary, the equity value of the company has been steadier. Thus, I will utilize the P/B ratio as a valuation tool.

The current company’s equity is $270.3 million, and the book value per share is $9.42. The stock is significantly discounted if you compare the five-year P/B ratio of 2.31 average with the current P/B ratio of 0.57.

The stock’s valuation is attractive as it trades at 60{171d91e9a1d50446856093950b947460c67b1ae5766d3d173ffede4594e3fbfb} of its book value. However, I will give the company a “Hold” rating due to its arguable lack of competitiveness, high inventory level and near-term macro headwinds.

As Buffett said:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.